7 Statistics That Show Why We Should Support Black-Owned Businesses

Why is it important to support Black businesses? Will supporting them really benefit Black communities in the long run? The success of Black businesses is crucial to increasing the wealth and success of Black people. However, the systemic racism that they face in all aspects of business ownership prevents their growth. Here are eight statistics that show why we should support Black-owned businesses for the long term.

1. There Are Less Black Business Owners

Black people represent 13% of the US population but only 4.3% of the country’s 22.2 million business owners. Why aren’t there more Black business owners? Black people are disadvantaged due to hundreds of years of systemic racism, and society today isn’t doing enough to be truly inclusive of Black people. Read on for more details.

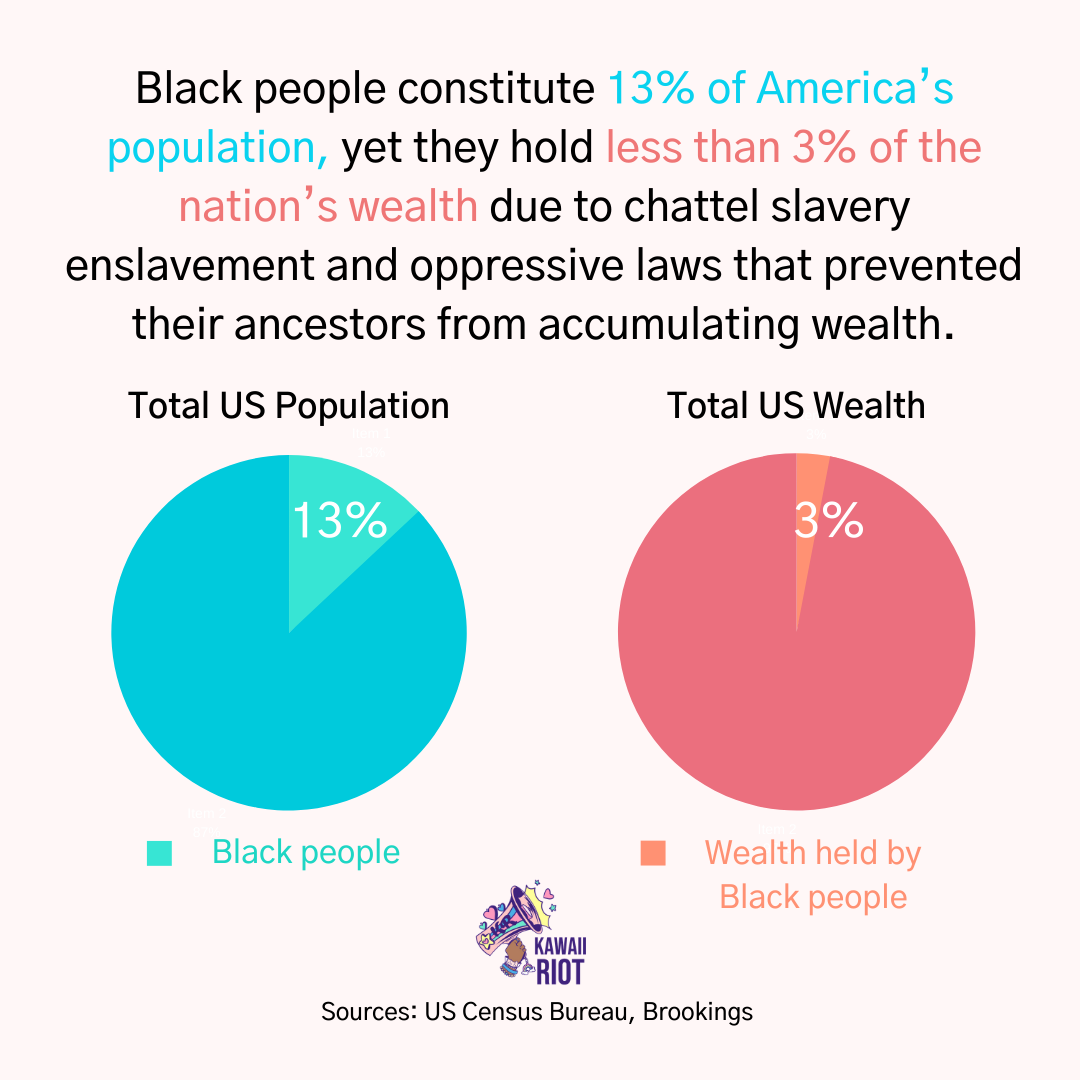

2. The Racial Wealth Gap Limits Their Success

Having spare money is essential to building a business before opening or turning a profit. However, Black entrepreneurs have access to less cash due to the huge racial wealth gap that has resulted from hundreds of years of discrimination. Black people constitute 13% of America’s population, yet they hold less than 3% of the nation’s wealth due to chattel slavery enslavement and oppressive laws that prevented their ancestors from accumulating wealth.

3. Businesses Increase Community Wealth

According to 2008 data, the median net worth (the cash a person has if they sell everything they own and pay all debts) for Black business owners is 12 times higher than Black non-business owners, and not because they started out wealthier. Small businesses also tend to hire employees from their own communities, which helps increase the wealth within Black communities. As a result, the success of Black business plays a large role in minimizing the racial wealth gap.

4. Racism in the Bank Industry

A bank loan is often necessary for businesses just starting out to cover their expenses. However, Black business owners are twice as likely as white business owners to be rejected for bank loans because of racism in the bank industry. Instead, banks target Black people for risky and unfair loans that end up damaging their credit scores. This in turn affects the success of their loan applications, resulting in a never-ending racist spiral that sucks wealth out of Black communities.

5. Low Black Representation in Venture Capital Firms

Venture capital (VC) firms are groups of investors that provide funding for startups or small businesses. Rather than creating debt, they gain a stake in the business that will produce a high return if the business is successful. Businesses can acquire large sources of funding from venture capitalists without paying it back, as well as advice from venture capitalists who want the business to perform well. VC can grow a business much more quickly than bank loans can. However, only 1% of VC-funded startup founders are Black due to the bias within firms: 81% of VC firms don’t have a single black investor because of hiring discrimination.

6. Hiring Discrimination Against Black People Remains High

Since 1990, white job applicants have received 36% more interview invitations than Black applicants with identical résumés due to hiring discrimination. Black people may seek freedom from this discrimination by founding their own businesses. They’ll also often hire Black employees and create an inclusive environment for them.

7. Black Businesses Receive Less Federal Aid

Black businesses have been unfairly affected by the coronavirus pandemic. According to the Census Bureau, over 38% of US small businesses received the assistance they applied for through Paycheck Protection Program (PPP) loans—a government loan that helps small businesses keep their workers employed. Yet a separate survey shows that only 12% of Black and Latinx small business owners received the assistance they applied for due to discrimination in banks.

Final Words

Black-owned businesses help funnel wealth into Black communities that have historically experienced socioeconomic disadvantages due to systemic racism. Yet racist institutions still block the growth and success of Black business owners. We can do more to uplift Black businesses and fight for their success. Learn about ways to support Black-owned businesses for the long term.

Citations

Darity, W., Jr., Hamilton, D., Paul, M., Aja, A., Price, A., Moore, A., & Chiopris, C. (2018, April). What We Get Wrong About Closing the Racial Wealth Gap. Retrieved from https://socialequity.duke.edu/wp-content/uploads/2020/01/what-we-get-wrong.pdf

Dreamers & Doers. (2020, June 12). How to go beyond buying and truly support Black-owned businesses, according to 4 Black entrepreneurs. Retrieved from https://www.businessinsider.com/how-to-support-black-owned-businesses-according-to-black-entrepreneurs-2020-6

Dua, A., Mahajan, D., Millan, I., & Stewart, S. (2020, June 05). COVID-19’s Effect on Minority-Owned Small Businesses in the United States. Retrieved from https://www.mckinsey.com/industries/social-sector/our-insights/covid-19s-effect-on-minority-owned-small-businesses-in-the-united-states

McIntosh, K., Moss, E., Nunn, R., & Shambaugh, J. (2020, February 27). Examining the Black-White Wealth Gap. Retrieved from https://www.brookings.edu/blog/up-front/2020/02/27/examining-the-black-white-wealth-gap/

Norman, J. (2020, June 19). A VC's Guide to Investing in Black Founders. Retrieved from https://hbr.org/2020/06/a-vcs-guide-to-investing-in-black-founders